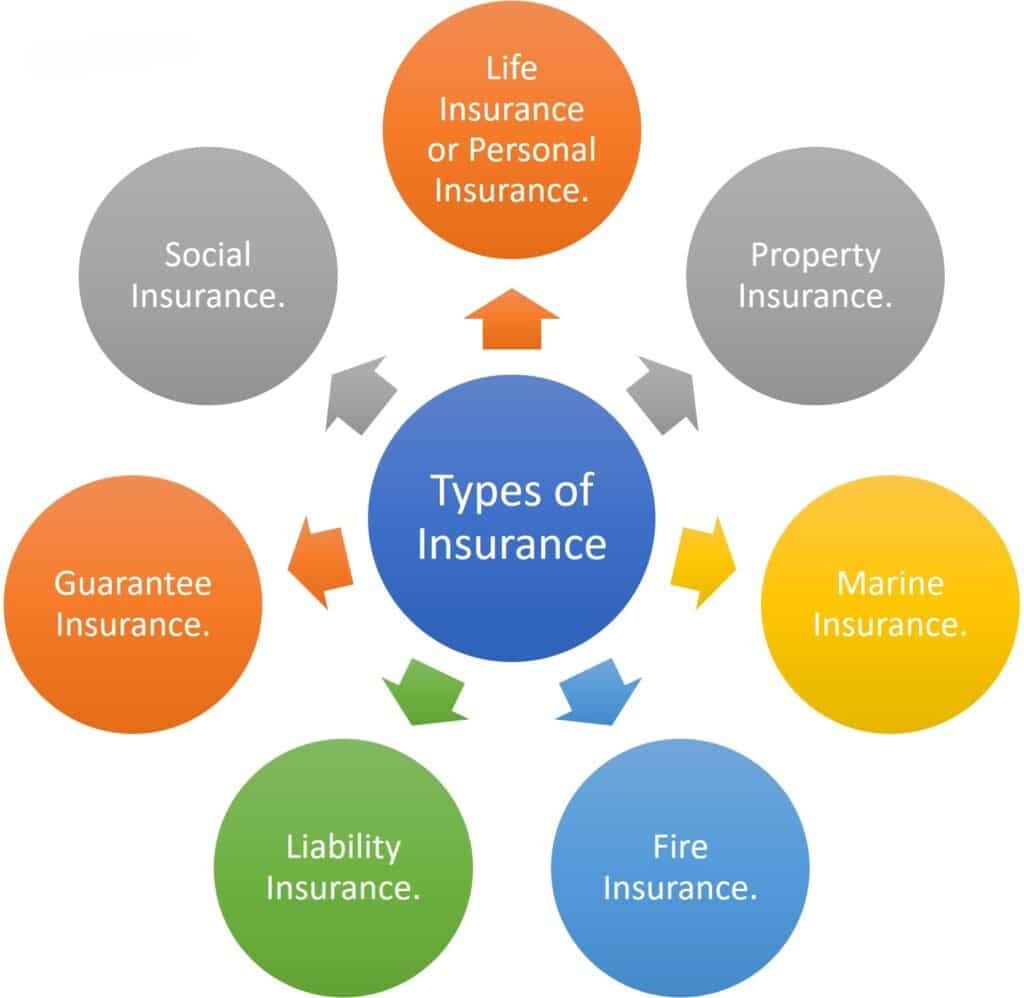

Insurance is a fundamental part of financial planning and risk management. It provides a safety net against unforeseen events, ensuring that individuals and businesses can recover from losses without severe financial hardship. In this comprehensive guide, we will explore the various types of insurance available, their importance, and how they can benefit you. Whether you are looking to protect your health, property, or financial future, understanding the different insurance options is crucial.

Introduction

Insurance is a contract between an individual or entity and an insurance company, where the insurer agrees to provide financial protection or reimbursement against losses in exchange for premiums. The main purpose of insurance is to mitigate financial risks and provide peace of mind. There are numerous types of insurance available, each designed to cover specific risks and needs. This article will delve into the most common types of insurance, including health insurance, auto insurance, home insurance, and life insurance, among others. By understanding these different insurance products, you can make informed decisions that best suit your personal or business needs.

Health Insurance

Health insurance is one of the most critical types of insurance, providing coverage for medical expenses incurred due to illnesses or injuries. It helps protect individuals and families from the high costs of healthcare.

1. Private Health Insurance

Private health insurance is coverage provided by non-governmental entities, often offered by employers or purchased individually.

- Features: Covers a wide range of medical services, including doctor visits, hospital stays, surgeries, and prescription medications.

- Benefits: Access to a broader network of healthcare providers, shorter wait times for treatments, and comprehensive coverage options.

- Considerations: Premiums can be higher than public health insurance, and coverage can vary significantly between policies.

2. Public Health Insurance

Public health insurance is provided by the government and includes programs like Medicare and Medicaid in the United States.

- Features: Designed to provide affordable healthcare to specific groups, such as the elderly, low-income individuals, and disabled persons.

- Benefits: Lower premiums or no cost at all, extensive coverage for essential health services.

- Considerations: Limited choice of healthcare providers, longer wait times for non-emergency treatments, and varying eligibility requirements.

3. Short-Term Health Insurance

Short-term health insurance provides temporary coverage for individuals who are between health plans, such as those transitioning jobs or waiting for other coverage to begin.

- Features: Covers basic medical expenses for a limited period, usually up to one year.

- Benefits: Lower premiums, quick approval process, and flexible terms.

- Considerations: Limited coverage, does not cover pre-existing conditions, and may not meet the minimum essential coverage requirements.

Auto Insurance

Auto insurance is mandatory in most places and provides financial protection against physical damage and bodily injury resulting from traffic collisions, as well as liability that could arise from incidents in a vehicle.

1. Liability Insurance

Liability insurance covers damages that the policyholder is legally responsible for, including bodily injury and property damage to others.

- Features: Mandatory in most states, covers legal fees and court costs.

- Benefits: Protects against financial loss due to lawsuits, covers medical expenses for injured parties.

- Considerations: Does not cover the policyholder’s own vehicle or injuries.

2. Collision Insurance

Collision insurance covers damages to the policyholder’s vehicle resulting from a collision with another car or object.

- Features: Optional coverage, typically required if the vehicle is financed or leased.

- Benefits: Pays for repairs or replacement of the policyholder’s vehicle.

- Considerations: Deductibles apply, and premiums can be high depending on the vehicle’s value and the driver’s history.

3. Comprehensive Insurance

Comprehensive insurance covers non-collision-related damages to the policyholder’s vehicle, such as theft, vandalism, natural disasters, and animal collisions.

- Features: Optional coverage, often required by lenders.

- Benefits: Broad coverage for various types of damage, peace of mind.

- Considerations: Deductibles apply, higher premiums.

4. Personal Injury Protection (PIP)

Personal Injury Protection (PIP) covers medical expenses and, in some cases, lost wages and other damages, regardless of who is at fault in an accident.

- Features: No-fault insurance, mandatory in some states.

- Benefits: Covers medical expenses, rehabilitation costs, and lost wages.

- Considerations: Coverage limits vary, may overlap with health insurance.

Home Insurance

Home insurance provides financial protection against damages to a home and the homeowner’s belongings, as well as liability coverage for accidents that occur on the property.

1. Homeowners Insurance

Homeowners insurance is designed for single-family homes and provides comprehensive coverage for the structure, personal property, and liability.

- Features: Covers damages from fire, theft, vandalism, and certain natural disasters.

- Benefits: Financial protection for home and belongings, liability coverage for accidents.

- Considerations: Does not cover all natural disasters, such as floods or earthquakes (additional coverage needed).

2. Renters Insurance

Renters insurance provides coverage for tenants living in rental properties, protecting their personal belongings and providing liability coverage.

- Features: Covers personal property against theft, fire, and vandalism.

- Benefits: Affordable premiums, liability coverage.

- Considerations: Does not cover the structure of the rental property, may require additional coverage for high-value items.

3. Condominium Insurance

Condominium insurance, or condo insurance, provides coverage for the interior of a condo unit and the owner’s personal property, as well as liability protection.

- Features: Covers personal property, interior walls, floors, and ceilings.

- Benefits: Protects the condo unit’s interior, liability coverage.

- Considerations: Does not cover the exterior of the building or common areas (covered by condo association’s master policy).

4. Landlord Insurance

Landlord insurance provides coverage for property owners who rent out their homes or apartments, protecting against property damage and liability claims.

- Features: Covers the rental property’s structure, liability protection.

- Benefits: Financial protection against damages caused by tenants, liability coverage.

- Considerations: Higher premiums than homeowners insurance, does not cover tenant’s belongings.

Life Insurance

Life insurance provides financial protection for the policyholder’s beneficiaries in the event of the policyholder’s death. It ensures that loved ones are financially supported after the policyholder’s passing.

1. Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, and pays a death benefit if the policyholder dies within the term.

- Features: Fixed premiums, coverage for a set period.

- Benefits: Affordable premiums, high coverage amounts.

- Considerations: No cash value, coverage ends after the term expires.

2. Whole Life Insurance

Whole life insurance provides coverage for the policyholder’s entire life and includes a cash value component that grows over time.

- Features: Lifetime coverage, fixed premiums, cash value accumulation.

- Benefits: Permanent coverage, cash value can be borrowed against or withdrawn.

- Considerations: Higher premiums than term life, surrender charges if policy is canceled early.

3. Universal Life Insurance

Universal life insurance is a type of permanent life insurance with flexible premiums and a cash value component that earns interest.

- Features: Flexible premiums, adjustable death benefit, interest-bearing cash value.

- Benefits: Flexibility in premium payments, potential for cash value growth.

- Considerations: Requires active management, premiums may increase over time.

4. Variable Life Insurance

Variable life insurance provides permanent coverage with a cash value component that can be invested in various financial instruments, such as stocks and bonds.

- Features: Investment options, potential for higher cash value growth.

- Benefits: Investment flexibility, potential for significant cash value growth.

- Considerations: Investment risk, higher premiums, requires active management.

Conclusion

Understanding the various types of insurance available can help you make informed decisions that provide the best protection for your needs. From health and auto insurance to home and life insurance, each type offers unique benefits and considerations. By choosing the right insurance products, you can safeguard your financial future and gain peace of mind.

Insurance is an essential part of financial planning, providing a safety net against unexpected events and helping to mitigate financial risks. Whether you are protecting your health, property, or loved ones, the right insurance coverage can make all the difference. If you have any questions or experiences to share about insurance, we invite you to leave a comment below. Your insights can help others make better financial decisions.